Fees apply. May not be suitable in all circumstances. Your credit rating may be affected.

MoneyHelper is a free independent service available to customers offering debt counselling, debt adjusting and providing of credit information services.

Fees apply. May not be suitable in all circumstances. Your credit rating may be affected.

MoneyHelper is a free independent service available to customers offering debt counselling, debt adjusting and providing of credit information services.

Understanding Debt Solutions in Northern Ireland

You may be struggling to keep up with the payments on credit card or store cards, with added late fees and interest making the balance spiral out of control. Perhaps the high interest rate you are being charged for personal loans means your monthly payments are merely servicing the interest and not reducing the overall balance.

We also regularly advise people who have fallen into arrears with their mortgage; although this is a very stressful situation to be in, there are options out there and we will do everything we can to help you keep your home.

Debt problems may arise through various situations including divorce, job loss, or simply by spending more money than you are bringing in. Whatever your situation, or the reason you have found yourself in debt, there is a way out of your problems.

Fully Regulated Advisers

Contact our team today to understand more about available debt solutions. At Northern Ireland Debt, we understand debt problems can be daunting to manage alone but taking the first step to acknowledge the situation is vital to begin the path to resolving your debts. Our advisers have helped thousands of individuals with their debts, and will take the time to understand your personal financial situation.

Debt Support Options

Northern Ireland Debt Solutions is dedicated to helping people in financial distress across Northern Ireland. If you’re struggling with unmanageable debt of over £5,000 and live in Northern Ireland, we can help you.

Contact our team of debt experts to find out more about which available debt solutions may be most appropriate for your personal situation.

How We Can Help

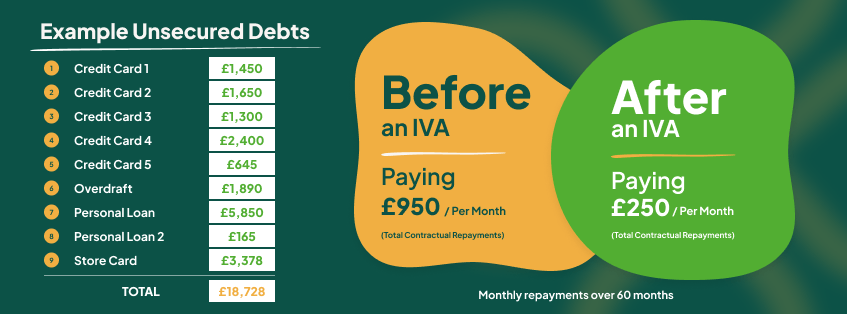

When it comes to personal debt, there are a number of formal debt solutions which can be used to help you manage the money you owe; from Individual Voluntary Arrangements (IVAs), through to Bankruptcy in the most serious cases. We also provide insolvency solutions for businesses debts, including rescue and closure options. The experts at Northern Ireland Debt Solutions can help you understand all of your options, before working alongside you to put a plan in place to help you move forward.

Helping Residents of Northern Ireland in Debt Since 1989

The experts at Northern Ireland Debt Solutions are dedicated to supporting individuals through their most trying financial times. If you have debts over £5,000, live in Northern Ireland, and are ready to tackle your debt problems, we can help.

We understand that everyone’s experience with debt is different, and that is why we pride ourselves on treating every customer as the individual they are. Our expert debt advisers will take the time to understand your situation, and work alongside you to put a plan in place which is both affordable and manageable.

For over thirty years we have been providing help, guidance, and support to individuals in debt, and we are here to help you too.

.

Get Started – Contact The Team Today

Ready to take the first step to a brighter future? Contact Northern Ireland Debt Solutions today to understand your next steps.